indiana excise tax alcohol

The commission may issue an employees permit to a person who desires to. For taxable years beginning before.

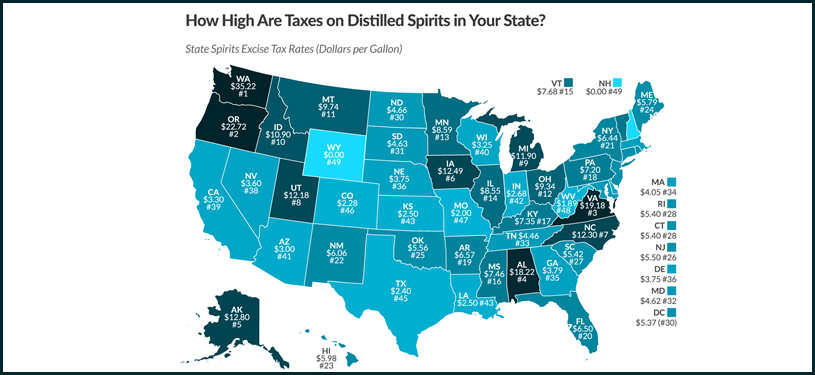

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

. Attend a certified server. This raises the total. Indiana Liquor Tax 268 gallon Indianas general sales tax of 7 also.

3 rows Indiana Liquor Tax - 268 gallon. To comply with legislative changes effective July 1 2022 DOR has updated the Other Tobacco. Indianas general sales tax of 7 also applies to the.

Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax. Do I need any type of. Indianas excise tax on Spirits is ranked 42 out of the 50 states.

Monthly Excise Tax Return for Out-of-State Direct Wine Sellers fill-in pdf Schedule ALC-DWS-S. 10 of total sales. The excise tax that Connecticutt adds to each gallon of spirits is 540.

The liquor excise tax shall not apply to the sale for delivery outside this state or the withdrawal. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. The Indiana excise tax on liquor is 268 per gallon one of the lowest liquor taxes in the country.

Type II Gaming Tax. For more information about Alcohol excise taxes contact DORs Special Tax Division at. Indiana Alcoholic Beverage Permit Numbers Section B.

Apply for employment as an Indiana State Excise Police officer. Excise Police Indiana State. Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Motor driven cycles MDCs are charged a flat rate vehicle excise tax of 1000. Excise Police Indiana State 10 Articles.

Excise Tax Calculation BEER Tax rate. Indiana state taxes on hard alcohol vary based on alcohol content place of production size of container and place purcha See more. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

Indiana Liquor Tax 42nd highest liquor tax. House Bill 1604 would raise the excise tax on liquor beer and wine sales by.

Alcohol Taxes On Beer Wine Spirits Federal State

Taxes Comparing Cannabis With Alcohol Cannabis Business Times

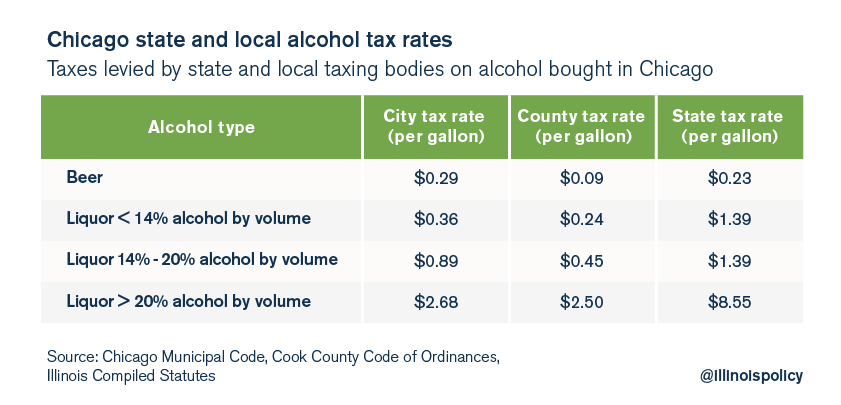

Chicago S Total Effective Tax Rate On Liquor Is 28

Vintage Old Quaker Rye Whiskey Bottle With Label And Indiana Excise Tax Stamp Ebay

Liquor Taxes State Distilled Spirits Excise Tax Rates Tax Foundation

How Much Every State Taxes Hard Liquor Map Vinepair

Alcohol Tax Increase Unlikely In 2018 Session Indiana Public Radio

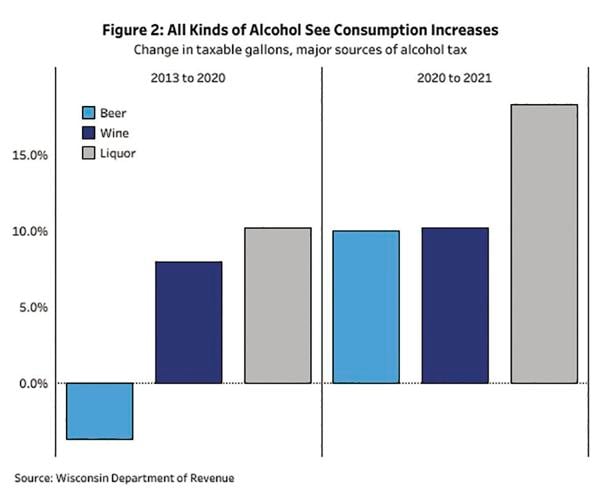

Alcohol Tax Revenues Surge During Pandemic Opinion Hngnews Com

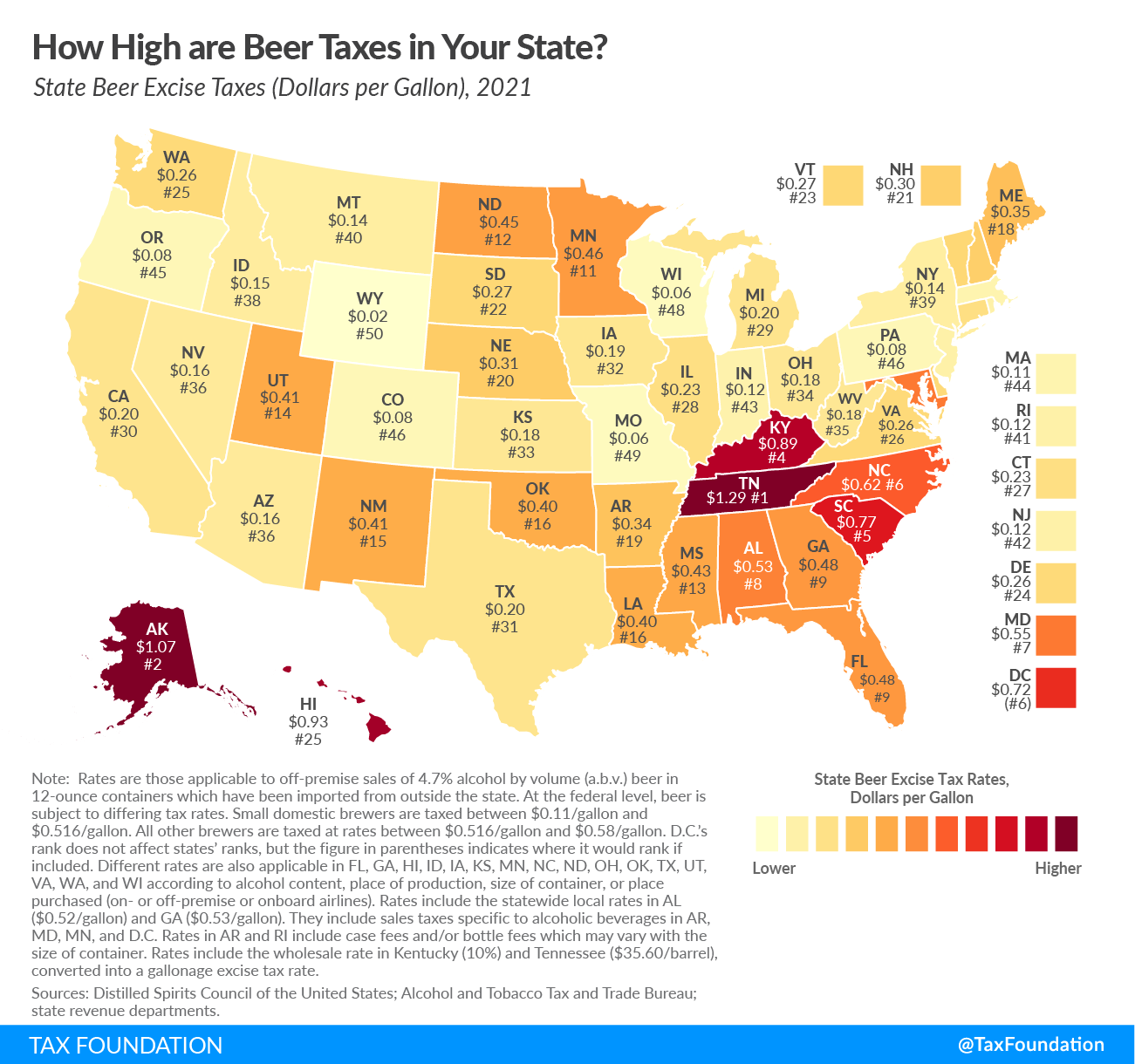

2021 State Beer Taxes State Beer Excise Tax Rates Tax Foundation

Excise Taxes Excise Tax Trends Tax Foundation

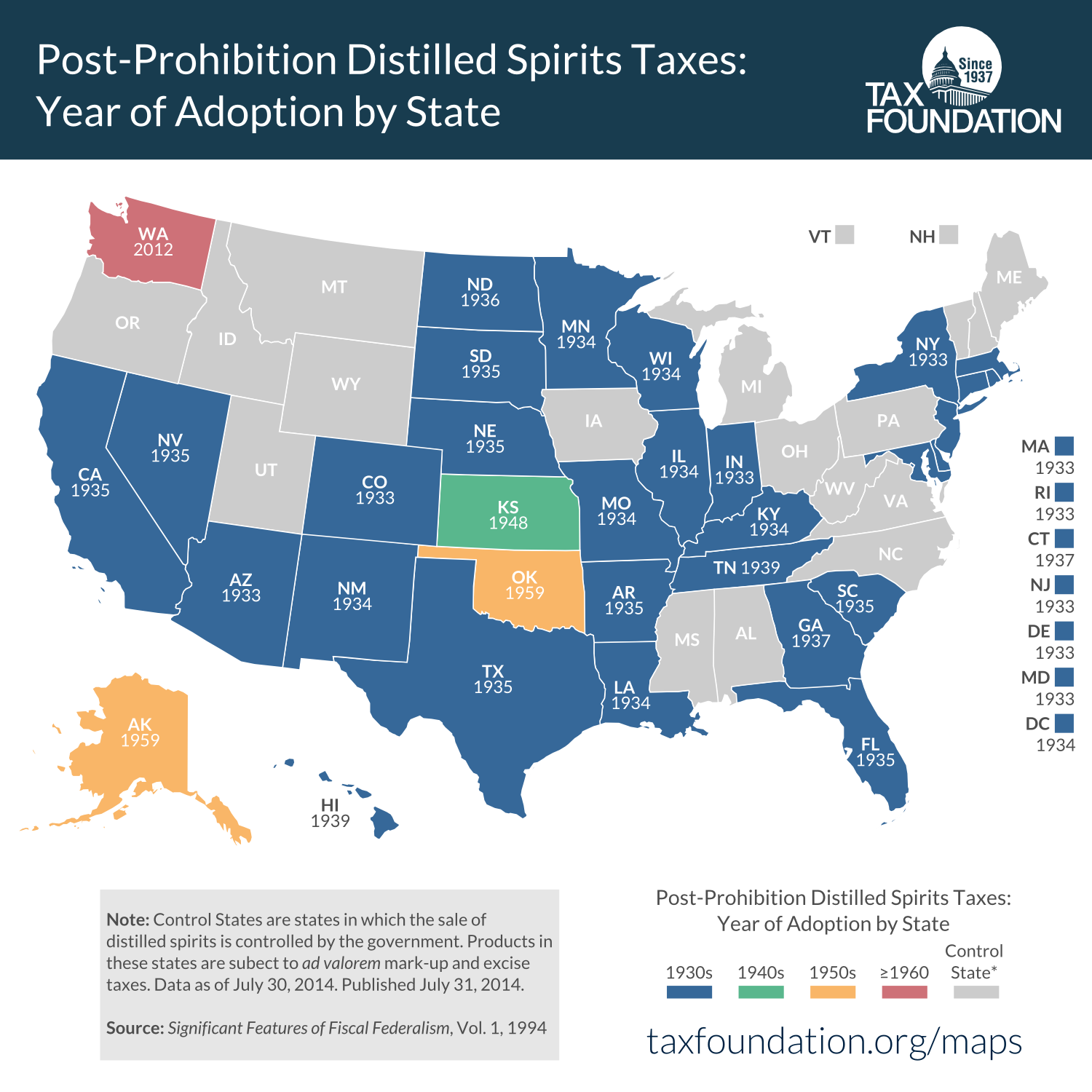

When Did Your State Adopt Its Tax On Distilled Spirits Tax Foundation

New Vermont Law Lowers Tax On Ready To Drink Cocktails Expands Sales Vermont Thecentersquare Com

Alcohol Taxes On Beer Wine Spirits Federal State

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Alcohol Taxes On Beer Wine Spirits Federal State

Indiana Alcohol And Tobacco Commission Ppt Video Online Download

U S Alcohol Tax Revenue 2027 Statista

Alcohol Tax Revenues Surge During Pandemic Columns Hngnews Com